SEASONALITY OF THE HURRICANE RISK IN INSURANCE-LINKED SECURITIES

The main hurricane risk of insurance-linked securities, that of North Atlantic hurricanes, is seasonal as opposed to following uniform distribution. The hurricane season officially starts on June 1 and ends November 30. Very few hurricanes occur outside the hurricane season. Approximately 97% of all tropical storm activity happens during these six months.As the the above diagram, there is a pronounced peak of activity within the

hurricane season, which lasts from August through October. Over three quarters

of storms occur during this period. The percentage of hurricanes, in

particular major hurricanes, is even greater: more than 95% of major hurricane

(Category 3 and greater) days fall from August through October.

Definition of hurricane season is rarely used in the offering documents for

insurance-linked securities. Instead, specific dates determine the coverage

period. Knowing when the hurricane season officially starts and ends is not

relevant. However, there are some insurance-linked securities for which the

definition of the hurricane season is important. Exchange-traded IFEX catastrophe

futures use a formal legal definition of North Atlantic hurricane season.

This definition is used in establishing maintenance margin levels for

IFEX contracts. Catastrophe futures and similar insurance-linked securities

are described in detail in other chapters.

Hurricanes threatening the Pacific coast of the US and Mexico have a

longer period of heightened activity, which starts earlier than on the Atlantic

coast but has the same activity peak as the North Atlantic hurricanes. West

Pacific hurricanes are distributed even more evenly over the year; they are

less important in securitisation of insurance risk.

Hurricanes in the Southern Hemisphere (called typhoons or cyclones

there) tend to occur between October and May, but specific frequency distributions

depend on ocean basin.

LANDFALL FREQUENCY IN PEAK REGIONS

threat in the southeastern US, The following two figures illustrate hurricane

landfall frequencies expressed as return periods. Unlike the figures

above, only landfalls – which typically are the only hurricane risk in insurance-

linked securities – are shown, with the two graphs corresponding to

hurricane Categories 1 and 5 on the Saffir–Simpson hurricane scale.

Return period is defined here as the long-term average of a recurrence

interval of hurricane landfalls of specific or greater intensity (category) at the

time of landfall. It can also be seen as the inverse of the annual exceedance

probability. Return period is usually measured in years.

Historical data is the best indicator of future hurricane frequencies. Of

course, this does not mean that a simple sampling of the historical frequencies

should be used in hurricane simulations. It means only that historical

data is the starting point of any model, which is also where we return to validate

the model once it has been built. A sound model is much more than just

fitting of a distribution to the existing data points; some extremely sophisticated

models have been created in recent years.

HURRICANE FREQUENCY AND SEVERITY EFFECTS OVER VARIOUS

TIME HORIZONS

Continuing to focus primarily on hurricanes affecting the US, three primaryphenomena affect hurricane frequency and severity, each operating over its

own time scale: short term, medium term and medium to long term.

1 Short term

ENSO, which stands for El Niño Southern Oscillation, is the cycle of consistentand strong changes in sea surface temperature, air pressure and winds

in the tropical Pacific Ocean. The two phases, El Niño and La Niña, typically

take three to five years to complete the cycle.

El Niño is the warm phase of the cycle, when the sea surface temperature in the tropical Pacific is above average. Its opposite, La Niña, is the phase when the temperatures are below

average. The warming and cooling affect the level and patterns of tropical

rainfall, which in turn has an effect on worldwide weather patterns and

hurricane frequency and severity.

El Niño is associated with lower-than-average tropical storm and hurricane

activity in the Northern Atlantic due to higher-than-average vertical

wind shear resulting fromthewind patterns during this phase of ENSO. The

probability of hurricanes and hurricane landfalls in the Caribbean and other

parts of the North Atlantic is significantly reduced during the regular hurricane

season.

At the same time, the weather patterns lead to an increase in

tropical storms and hurricanes in the eastern tropical North Pacific.Results of

the La Niña phenomenon are the opposite: storm formation and hurricane

activity are increased in the North Atlantic during the hurricane season,while

in the Pacific the probability of hurricanes is lower than average. These two phases of ENSO are not equal in time.

El Niño rarely lasts longer than one year, while La Niña tends to take between one and three years. There is no strict cyclicality here, in the sense that each of the two phases can have shorter or much longer durations than expected. The general relationship, however,

usually holds, with periods of increased hurricane activity in the Atlantic

being longer than periods of decreased activity.

Technically speaking, El Niño and La Niña are not truly two phases of the

ENSO cycle. The end of El Niño leads to an ENSO-neutral period, which

may not be followed by a pronounced La Niña phenomenon and can

instead go back to the El Niño stage. Similarly, La Niña may not be followed

by a pronounced El Niño stage.

ENSO affects not only the frequency but also the severity of hurricanes.

One reason for this is the vertical wind shear effect, where hurricane intensity in the Atlantic is dampened during El Niño and increased during La

Niña. In addition, the tropical storm formation centres differ slightly and the

hurricanes follow different tracks. La Niña results not only in a greater

frequency of hurricanes in the Atlantic but also in a greater probability of

hurricanes being formed off the west coast of Africa. These hurricanes have

a higher chance of increasing in intensity and making a landfall in the US or

Caribbean as major hurricanes.

The following figure shows an anomalous increase in sea surface temperature

indicative of the arrival of El Niño and the expectation of lower hurricane

activity in the Atlantic.

2 Medium term

AMO, which stands for Atlantic Multidecadal Oscillation, is a cycle ofconsistent and strong changes in sea surface temperature in the North

Atlantic. The cycle is believed to be on the order of 70 years, with the up and

down phases approximately equal in time. The amplitude of the temperature

variations due to the AMO is much milder than that resulting from

ENSO, and the changes much slower. It is believed that we are currently in of the warm phase. This phase is expected to end between 2015 and 2040.

AMO has some effect on the overall frequency of tropical storms and

hurricanes, with warmer temperatures contributing to the tropical storm

system development and colder temperatures leading to a reduction in tropical

storms.

This correlation is not strong and the effect is usually

disregarded. However, during the warm phases of the cycle there is a

greater chance of major hurricanes compared with the average; the chance

is lower during the cold phases. This effect is unambiguous and the correlation

is strong.

3 Medium to long term

Climate change, in particular the increase in seawater temperature, has astrong potential to increase both the frequency and the severity of the hurricanes

landfalling on the Atlantic coast of the US. Some of the change is the

result of human activities.

Global warming, recognised by the majority of

the scientific community, is part of the overall climate change. There is no

consensus on the exact manifestations of and the speed at which climate

change is happening. Some would argue that categorising climate change as

having medium- to long-term effect is wrong, and that substantial changes

are already happening rapidly and will accelerate.

The risk of abrupt climate change triggered by concurrent development of several factors has been repeatedly pointed out. Even those who subscribe to the global-warming

view without any reservations are unclear on the long-term effects of this

process. In fact, some research has suggested that the increase in the

seawater temperature will lead to a significant increase in hurricane activity

in the North Atlantic, but that at some point the process will reverse itself

and the hurricane frequency will actually decrease even if the temperature

continues to rise. This, however, is a minority opinion.

While global warming remains a controversial topic, in particular because

different people seem to attribute different meanings to the term, it is widely

accepted that seawater temperature has been rising and that the probability

of hurricanes in the North Atlantic is increasing as a consequence. This

correlation has direct applications for hurricane modelling.

INVESTOR VIEWS ON MACRO-SCALE FREQUENCY AND SEVERITY EFFECTS

In the analysis of catastrophe insurance-linked securities tied to the risk ofhurricanes, investors have a short-term view due to the relatively short tenor

of these securities. Whether the probability of hurricanes will be greater in

15 years is not germane to the probabilistic analysis of cashflows from a catastrophe bond that matures in two years. To the degree that long-term phenomena such as climate change are already affecting the probability of hurricanes, they are relevant to and should be incorporated in the analysis.

The difficulty is in having to work with very limited data samples, because,

sometimes, these can provide only anecdotal evidence of the degree to

which long-term processes are already affecting hurricane development and

will continue to do so within the period an insurance-linked security is

expected to remain outstanding.

In practice, it is currently very difficult to

separate and then separately model effects of the general climate change.

Shorter-term effects such as ENSO, on the other hand, can be better

modelled and incorporated in the analysis. To a lesser degree, the same is

true in regard to AMO. Other processes, such as the overall warming related

to climate change, are often incorporated indirectly through their influence

on the observed parameters of the better-understood processes of storm

formation and development.

There is a broad issue of whether, and to what degree, catastrophe models

should reflect the observed increase in hurricane activity in the North

Atlantic. Following Katrina and the 2004–2005 hurricane seasons in general,

there was an almost universal conviction that the frequency of hurricanes in

the widely used commercial models was significantly understated.

(There were also concerns about how other modules of the models performed, and

whether the damage and loss severity were understated.) Since then, the

models have been modified to produce loss results that are greater than

would be expected based purely on long-term historical data, either as the

main output or as an option available to the user.

The change reflects the view that the long-term observations do not represent the current atmospheric conditions that affect formation, development and landfalling of

tropical storms and hurricanes. This important practical issue is discussed

further below and in other articles.

Incorporating short-term effects such as ENSO in both the models and the

general analytical approach can better capture the risk profile of insurancelinked

securities and provide competitive advantage to investors able to do

it. For example, if El Niño starts, which can happen fast and unexpectedly,

short-term probabilities of North Atlantic hurricane losses will immediately

be affected. This affects the risk profile of the insurance-linked securities

exposed to this risk.

The knowledge of lower expected hurricane activity has

immediate application in pricing new insurance-linked securities and those

that can be traded in the secondary markets. Another practical application is

reassessing portfolio risk and return profile in light of the information on El Niño’s start. This reassessment might identify a change in the risk and

return profile of the overall ILS portfolio. The practical result would be a

conclusion regarding which risk buckets have to be filled and which

reduced, and the right prices for doing so.

Knowledge of expected changes in hurricane activity in the short term,

along with the ability to quantify the degree of the change, can create a

competitive advantage in the environment when many investors are not

using proper models at all and few are able to incorporate new information

in their modelling process.

With some exceptions, quantifying the impact of

new information such as the start of El Niño is not performed by the modelling

firms. Users of the models might have a view on the adjustments to

parameters that have to be made, but are unlikely to be able to properly

incorporate these changes in the standard modelling tools. This area is ripe

for improvement; new approaches are expected to be developed in the near

future. For now, some use adjustments made primarily on judgement. These

adjustments might or might not be implemented at the assumptions level,

as opposed to modifying the results of modelling.

The ability to reflect short-term frequency and severity effects of atmospheric

processes to properly assess risk is an advantage in trading

catastrophe bonds; it is an even greater advantage in investing in and

trading shorter-term instruments such as ILWs and catastrophe derivatives.

There is also a question of making better predictions of landfall probabilities

and associated losses of tropical storms that have already formed, which is

important in “live cat” trading; but these very short-term predictions have a

low degree of dependence on the macro-scale hurricane frequency effects

described here.

The discussion about reflecting macro-scale frequency effects in quantifying

the natural catastrophe risk in insurance-linked securities is irrelevant

to most investors, since they do not attempt to make any adjustments. Their

analysis might still capture some of these effects to the degree that the standard

modelling software packages used in catastrophe modelling might

give greater weight to recent years, as opposed to being calibrated based

simply on the long-term historical record of observations.

While this approach on the part of investors is inadequate and easy to criticise, it

reflects the degree of difficulty of determining and quantifying the effects of

macro-scale atmospheric processes on hurricane activity. A high level of

expertise is required to do it properly, and there is a significant degree of

uncertainty associated with these adjustments.

EVOLUTION OF INVESTOR VIEWS ON CATASTROPHE MODELLING

Incorporating short-term effects in catastrophe modelling has grown inimportance over time. Given that, for catastrophe bonds, buy-and-hold used

to be the only investment strategy, modelling was often performed only

once. Investors rarely tried to perform any real modelling and relied fully on

the analytical data in the offering circulars.

Many did not do even that and

based their investment decisions on other considerations, of which bond

ratings were the most important. Of course, even then there were investors

with deep understanding of insurance-linked securities; however, they

tended to be an exception rather than the rule. Even investors with a high

level of expertise in catastrophe risk, such as reinsurance companies, often

based the decisions on only a rudimentary overview of the summary

analysis provided in the offering circulars.

Some attempts to revisit the original

analysis would sometimes take place in the context of portfolio

construction, with a single focus on avoiding excessive risk accumulation in

some combinations of geographies and perils. Again, this statement is not

universally applicable, since from the very beginning some of the players in

the ILS market have been very sophisticated.

As the market has continued to develop, the level of sophistication of

many investors has grown with it, even though a significant disparity

remains. There are some ILS investors who lack any analytical expertise, and

some who believe they understand the analytics while in reality they do not.

In general, however, the current landscape is very different from what it

was in the beginning of the cat bond market. There are more new issues and

bonds outstanding. There is a sizable and growing secondary market for

catastrophe bonds.

This creates new opportunities for portfolio rebalancing

and optimisation. In addition, the ILW market has grown significantly.

Catastrophe derivative markets have reappeared and are growing as well.

Investors able and willing to take part in these markets and not be confined

to investing in catastrophe bonds have new options to generate higher riskadjusted

return by investing in catastrophe risk insurance-linked securities.

Direct hedging can be done in managing an ILS portfolio. The markets

remain inefficient and liquidity insufficient, but the array of options available

to investors has certainly expanded.

The ability to better model the risk has always been important in the

analysis of individual securities. The better tools now available for this

modelling have given investors a greater degree of confidence in the

analysis and opened new options not available several years ago.

RELATIONSHIP BETWEEN ILS INVESTOR SOPHISTICATION AND THE LEVEL OF ILS ANALYTICAL EXPERTISE

There is an obvious connection between the level of investor sophisticationand the ability to analyse the securities being invested. However, investing

in insurance-linked securities without being able to fully analyse them does

not necessarily put an investor in the “naïve” category.

There could be very good reasons for arriving at a well-thought-out decision not to expand

resources on developing internal expertise in insurance-linked securities,

but instead to allocate a small percentage of the overall funds to this asset

class without performing in-depth analysis.

One of the reasons could be the diversifier role that insurance-linked securities can play in a portfolio. Given a very small percentage allocation to ILS, for some investors the

cost–benefit analysis might not justify developing an expertise in this asset

class, though they may still have sufficient reasons for investing in ILS.

An even more important development stemming from the advances in modelling catastrophic events is the ability to better model and optimise portfolios of catastrophe insurance-linked securities. The new options available to investors – more new issuances; the development of secondary markets in catastrophe bonds, combined with a greater number of

outstanding bonds; the availability of ILWs and catastrophe derivatives,

both exchange-traded and over-the-counter – have also increased the need

for models that can be used in portfolio and risk management.

The shift from the buy-and-hold investment strategy as the only available option to

the ability, no matter how limited, to optimise and actively manage a portfolio

of insurance-linked securities is a sea change for a sophisticated

investor. Modelling insurance-linked securities on a portfolio basis has

increased the emphasis on modelling.

Some of the new modelling tools developed specifically for investors are described later in this article. A sophisticated investor can also take advantage of the live cat trading

opportunities arising when a hurricane has already formed and is threatening

an area that has significant insurance exposure. Short-term forecasts

can then be combined with broader portfolio modelling to take advantage

of the opportunities to take on risk at attractive prices, or to offload excess

risk in the portfolio.

So far, very little live cat trading has been done, but at least some growth in this area is expected. Improvement in the ability to model catastrophe risk contributes to the

development of the ILS markets. Enhanced tools give investors a higher

degree of confidence and open up new options.

At this point, however, most investors do not utilise the tools already available, and many make their investment decisions based primarily on judgement and a back-of-the-envelope

type of analysis. While there are some extremely sophisticated players

in this market, there is significant room for improvement in investor understanding

and modelling of catastrophe insurance-linked securities.

ELEMENTS OF HURRICANE MODELLING

Doubt is not a pleasant condition, but certainty is absurd.Voltaire

There is a very high degree of uncertainty associated with hurricane losses.

It surrounds all elements of a hurricane model – from the frequency and

location of storm formation to its tracks and intensity, and the possible landfall

and resulting insured losses. The very high degree of uncertainty has

been a continuing source of frustration for many investors who rely on the

output of black-box-type modelling tools such as the analysis summarised

in offering circulars for cat bonds.

It is even more frustrating for those fewinvestors for whom the modelling tools are not black boxes and who understand the assumptions and the modelling of individual processes within the broader analytical framework. Their superior understanding does not eliminate

the uncertainty and might even increase the perception of the degree

of uncertainty in their minds.

We need to keep in mind that the obvious uncertainty involved is not unique to insurance-linked securities tied to catastrophe risk: to some degree it is present in any security and financial instrument. Insurance-linked securities are unique in the type of risks they

carry; they are not unique in the carrying of risk per se. Every security carries

some degree of risk, uncertainty and unpredictability; assuming the risk is

what investors are paid for. In the case of insurance-linked securities, one of

the ways to reduce the uncertainty is to improve the modelling of hurricanes

and the damage they cause.

There exists a considerable body of research on modelling atmospheric

phenomena such as storms and hurricanes. Catastrophe models used in the

insurance industry and in the analysis of insurance-linked securities are

based on some of this research, as described earlier.

A comprehensive overview of the atmospheric science on which the commercial models are

based would take up a thick volume and cannot be provided here. In most

cases, understanding all of the science is completely unnecessary for an

investor analysing insurance-linked securities. It is important, however, to

have some basic understanding of the science and assumptions used in catastrophe

software packages and avoid treating these tools as black boxes that spit out results based on user input.

Among the many advantages of understanding

the basics of the science and assumptions used by the models is the

ability to better understand the sensitivity of results and the degree of uncertainty

involved. Another important advantage is understanding some of the

differences between the models.

Some elements of the modelling of hurricane risk and related basic scientific

concepts are discussed below. They are not intended to educate a reader

on the hurricane science as such, or even its use in commercial catastrophe

models: rather, the purpose is to provide an illustration of how the models

work, by describing selected issues relevant to the topic.

Modelling hurricane frequency

The number of storms in a hurricane season can be simulated by samplingfrom the hurricane frequency distribution. When the frequency of hurricanes

or hurricane landfalls is modelled directly, there are three main

choices for the probability distribution:

- Poisson;

- negative binomial; and

- binomial.

distributions. Binomial distribution might be appropriate where the sample

variance is less than the sample mean. This is unlikely to be the case in

events with such a high degree of uncertainty as hurricanes; the fact that

there can be several hurricanes during the same time period further complicates

the use of this distribution.

In fact, the variance generally exceeds the mean, leading to the recent adoption by many of the negative binomial as the distribution of choice for hurricane frequency. Most of the standard catastrophe models utilise the negative binomial distribution for hurricane

frequency in Florida; some allow users the choice between Poisson and

negative binomial distributions.

Despite the recent shift towards the use of the negative binomial distribution,

Poisson distribution is still commonly used as well. When considering

the choice of probability distribution for hurricane frequency, parameterisation

might be a bigger issue than the analytical form of the distribution. This

is particularly challenging because of the varying views on the changes in

hurricane frequencies over time.

In fact, the regime switch view of the hurricanefrequency affects both the choice of the parameters of the distribution and the choice of the distribution itself. It is possible that the statistically significant fact of the sample variance exceeding the sample mean is the

result of inappropriately combining in the same sample unadjusted observations

from time periods that have had different mean hurricane

frequencies due to climate oscillations or other changes.

If this is the case, the choice of Poisson distribution over the negative binomial might be preferable. In this context, the choice of the distribution is dependent on the choice

of the distribution mean: if it is determined based on the full historical database

of observations, with all observations given the same weight, negative

binomial distribution seems to almost always outperform Poisson in backtesting

regardless of the geographical region being considered.

Hurricane frequency and intraseasonal correlation

There is an ongoing debate about whether the occurrence of a hurricane, inparticular a major hurricane, during the hurricane season means that there

is a greater probability of another hurricane occurring in the remainder of

the season. In other words, there is a question of whether the frequency

distribution changes if it is conditioned on an occurrence of a hurricane.

The phenomenon in question is sometimes referred to as hurricane clustering.

The rationale for the view that the probability of hurricanes increases

under these circumstances is that a major hurricane is more likely to develop

if the general atmospheric conditions are more conducive than average to

hurricane formation. This in turn implies a greater-than-otherwise-expected

chance of additional hurricanes during the season.

In the analysis of insurance-linked securities, the issue of intra-seasonal

correlation is of particular importance for second-event bonds and second event

catastrophe derivatives. Of course, it is important in ILS analysis in

general for valuation purposes as well as for evaluating opportunities in the

catastrophe bond secondary markets. It could be of even greater consequence

in the context of investment portfolio management.

If the probability of hurricane losses on the US Atlantic coast has increased, it could affect

several securities and have a magnified effect across the portfolio.

In practice, we would be hard pressed to find investors who go through

the process of calculating conditional probabilities of hurricane events. The

standard commercial catastrophe models do not have an easy way to adjust

the probabilities in the middle of a hurricane season based on the occurrence

of an event such as Category 3 hurricane making a landfall in the US or the

Caribbean. There have been attempts to take the intra-seasonal auto correlation

into account in modelling second-event catastrophe bonds.

A better approach than auto correlation models or making adjustments to the frequency distribution based largely on judgement would be to instead

adjust the atmospheric parameters in the model. If the occurrence of a hurricane

was indicative of changing atmospheric conditions, then the best way

to reflect it in the model is by making changes to these assumptions. The

approaches of using auto correlation methods or of making adjustments

based primarily on judgement are also important.

Wind field modelling

Storm track modelling and modelling of the characteristics of the storm arean essential part of the overall hurricane modelling. Characteristics of the

storm at a particular location include central pressure, direction, forward

velocity, maximum winds, air pressure profile and many others.

Some elements of wind field modelling are shown in the following diagram. The

approach shown is just one of many ways to build wind field models.

The important output of wind field models that is used in insurance catastrophe-

modelling software packages is the wind characteristics after

hurricane landfall, at specific locations where insured exposure is located.

Parameterisation of the models is a challenging task that has the potential

to introduce uncertainty and, in some cases, lead to significant errors.

While historical observations are used to calibrate and validate the models, the

sample of observed events is not big enough to credibly estimate a large

number of parameters. A very complex and scientifically sound theoretical

wind field model might be completely useless in practice if it requires estimating

a large number of parameters based on empirical data. This

statement is not limited to wind field models and is applicable to most

elements of hurricane modelling.

Probability distributions of some wind field parameters

In the same way as there are several wind field models, there is more thanone way to model individual parameters used in these wind field models.

Most wind field models use the same general parameters.

Below we look at the examples of probability distributions of some of the stochastic parameters, in particular the ones used in the standard commercial catastrophe

models, as these are of most interest to the practitioner.

Annual frequency

Generating storm formation frequency technically is not part of wind fieldmodelling and comes before it, as does generating hurricane landfall

frequency in most models. Hurricane frequency has been covered above,

Wind field modelling is a critical part of simulating hurricanes and resulting

insurance losses. Various models have been developed; even for the same

model, parameterisation differs from one modeller to another. For illustrative

purposes, below we show selected elements of one of the wind field

models.

Pressure isobars of a cyclone can be modelled as concentric circles

around its centre. One of the standard models for the radial distribution of

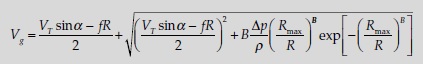

surface pressure is

where p(R) is the pressure at a distance R from the centre of the cyclone, p0

is central pressure, Rmax is radius to maximum winds, Dp is the central pressure

difference, and B is a scaling parameter reflective of pressure profile.

There are a number of models for the Holland parameter B, one of the

simplest being B = a + bDp + cRmax , where a, b and c are constant.

is central pressure, Rmax is radius to maximum winds, Dp is the central pressure

difference, and B is a scaling parameter reflective of pressure profile.

There are a number of models for the Holland parameter B, one of the

simplest being B = a + bDp + cRmax , where a, b and c are constant.

In this formulation, dependence on latitude is taken into account indirectly

through other parameters. A popular wind field simulation model is based

on the gradient balance equation of the following form:

through other parameters. A popular wind field simulation model is based

on the gradient balance equation of the following form:

from the cyclone translational direction to the site (clockwise considered

positive), r is the air density, f is the Coriolis parameter and VT is the

cyclone translational speed.

Using the pressure distribution model described above, we obtain the

following formula for gradient wind speed:

Gradient wind speed Vg can then be used to determine wind speed at

various heights. A number of decay models can be used to simulate the

evolution of wind parameters upon landfall. These will be utilised in calculating

wind gusts over land, taking into account surface roughness and

general topography.

various heights. A number of decay models can be used to simulate the

evolution of wind parameters upon landfall. These will be utilised in calculating

wind gusts over land, taking into account surface roughness and

general topography.

where two functional distribution forms – Poisson and negative binomial –

have been described as the most appropriate, with a general shift to using

the negative binomial distribution because the variance of observed hurricane

frequencies typically exceeds its mean. Parameters of the distribution,

whether negative binomial or Poisson, are estimated based on a smoothing

technique to account for the low number or lack of observations in most

locations.

have been described as the most appropriate, with a general shift to using

the negative binomial distribution because the variance of observed hurricane

frequencies typically exceeds its mean. Parameters of the distribution,

whether negative binomial or Poisson, are estimated based on a smoothing

technique to account for the low number or lack of observations in most

locations.

Landfall locations

If the landfall frequency is estimated directly by location based on one of the

methods described above, there is no need to use any distribution to estimate

landfall location probabilities. Otherwise, given the general hurricane

landfall frequency, the probability of landfall by specific location can be

distributed based on smoothing of empirical data or using a physical model.

Other approaches can be used as well.

methods described above, there is no need to use any distribution to estimate

landfall location probabilities. Otherwise, given the general hurricane

landfall frequency, the probability of landfall by specific location can be

distributed based on smoothing of empirical data or using a physical model.

Other approaches can be used as well.

Central pressure

Smoothed empirical distributions can be used for central pressure at and

following landfall. The same approach is possible but harder to implement

for modelling hurricane central pressure before landfall. While central pressure

does not easily lend itself to being described by any standard functional

probability distribution, the use of Weibull distribution has produced

acceptable fit. Strong hurricanes are much rarer than the weak ones, and the

Weibull distribution, with properly chosen parameters, captures this relatively

well.

following landfall. The same approach is possible but harder to implement

for modelling hurricane central pressure before landfall. While central pressure

does not easily lend itself to being described by any standard functional

probability distribution, the use of Weibull distribution has produced

acceptable fit. Strong hurricanes are much rarer than the weak ones, and the

Weibull distribution, with properly chosen parameters, captures this relatively

well.

Forward speed

Smoothed empirical distribution specific to a landfall gate is one of the

choices for modelling hurricane forward speed. Similar to the central pressure

distribution, that of forward speed is skewed, with very fast forward

speeds being much less common than slower speeds. However, based on

historical observations, the degree of skewness is generally lower.

Lognormal distribution is a good choice for modelling storm forward speed

in most situations.

choices for modelling hurricane forward speed. Similar to the central pressure

distribution, that of forward speed is skewed, with very fast forward

speeds being much less common than slower speeds. However, based on

historical observations, the degree of skewness is generally lower.

Lognormal distribution is a good choice for modelling storm forward speed

in most situations.

Radius to maximum winds

Lognormal distribution can be used for modelling Rmax, with its parameters

depending on central pressure and location latitude. The lognormal distribution

needs to be truncated to avoid generating unrealistic values of Rmax.

depending on central pressure and location latitude. The lognormal distribution

needs to be truncated to avoid generating unrealistic values of Rmax.

Gamma distribution has also been used for stochastically generating radius

to maximum winds, producing acceptable results when limited to modelling

the Rmax variable at landfall as opposed to including its modelling over

open water. Another way to generate Rmax values is by using one of the

models where logarithm of Rmax is a linear function of central pressure

(and/or its square) and location latitude.

to maximum winds, producing acceptable results when limited to modelling

the Rmax variable at landfall as opposed to including its modelling over

open water. Another way to generate Rmax values is by using one of the

models where logarithm of Rmax is a linear function of central pressure

(and/or its square) and location latitude.

Coefficients in the linear relationships are determined based on empirical data. Then Rmax is not simulated directly, but rather is calculated as a function of latitude and the simulated

value of central pressure. Other models can also be used.

These are just some of the random variables simulated in catastrophe

models. Many others need to be modelled, including such important ones as

wind dissipation overland, in order to ultimately derive hurricane physical

parameters after a landfall.

value of central pressure. Other models can also be used.

These are just some of the random variables simulated in catastrophe

models. Many others need to be modelled, including such important ones as

wind dissipation overland, in order to ultimately derive hurricane physical

parameters after a landfall.

DAMAGE MODELLING

In catastrophe models, the next step after simulating physical effects of a

hurricane (such as peak gusts and flood depth at specific locations) is determining

the damage they cause. Conceptually, this process is very

straightforward. It involves the following basic steps:

1. For each individual location in the insured exposure database,

consider

In catastrophe models, the next step after simulating physical effects of a

hurricane (such as peak gusts and flood depth at specific locations) is determining

the damage they cause. Conceptually, this process is very

straightforward. It involves the following basic steps:

1. For each individual location in the insured exposure database,

consider

- simulated physical characteristics of the storm that are relevant to estimating potential damage;

- characteristics of the insured property at the location.

2. Identify the damage functions corresponding to the hurricane’s physical

parameters (peak gusts) and the vulnerability classes of insured

buildings and contents at the location.

3. Apply the damage functions to the replacement value of the insured

property to calculate the loss.

Detailed information on the insured property is essential for assessing its

vulnerability to hurricanes. The information should include the following,

in as great detail as possible:

parameters (peak gusts) and the vulnerability classes of insured

buildings and contents at the location.

3. Apply the damage functions to the replacement value of the insured

property to calculate the loss.

Detailed information on the insured property is essential for assessing its

vulnerability to hurricanes. The information should include the following,

in as great detail as possible:

- precise location of the insured property (street address, ZIP code, CRESTA, etc.);

- vulnerability characteristics (construction type, height and footprint size, year of construction, occupancy type, mitigating factors, etc.); and

- replacement property value.

analysis. Their details represent a highly proprietary component of

commercial catastrophe models that can be a significant differentiator

among the models. The exact definition of a vulnerability function is the

relationship between the mean damage ratios and the peak gusts, where the

mean damage ratio relates the expense of repairing the damaged property

to the replacement cost of the property.

Modifications to vulnerability functions or subsets of vulnerability functions

can be based on secondary characteristics or mitigation measures such

as roof type, roof strength, roof-to-wall strength, wall-to-floor and wall-tofoundation

strength, opening protection and others. The variables are

largely the same for all models since they are a function of the type of exposure

information collected by insurance companies.

The way vulnerability functions are determined and modified differs, sometimes significantly,

from one model to another. Some models use additional variables such as

wind duration to better estimate damage to insured property from hurricanes.

The fact that damage modelling follows very simple and logical steps

does not imply the ease of building a module for its calculation as part of a

catastrophe model.

The effort going into determining and refining vulnerability

functions cannot be overestimated. Complex structural engineering

studies have been conducted for this purpose and a large amount of historical

hurricane damage data has been analysed. This is a continuing process

as more precise site information becomes available, building codes change

and other developments take place.

FINANCIAL LOSS MODELLING

Once the damage for each insured location has been calculated, it can thenbe translated into the amount of insured loss by applying to it policy terms

and conditions including its deductible and limit. Loss triggers, insurance

coverage sublimits and other factors are also taken into account in the calculations;

for reinsurance purposes, other factors such as attachment point are

also part of the loss calculations.

This process too is very straightforward in

its implementation as long as all the necessary data inputs are reliable.

Adjustments to the process, when such are required, can introduce a

degree of complexity. Adjustments include taking into account demand

surge following a catastrophic event.

WIND AND EARTHQUAKE STRUCTURAL ENGINEERING ANALYSIS

The ability to estimate potential damage to insured structures depending onthe physical characteristics of a hurricane or an earthquake is a challenging

structural engineering task. Two separate disciplines, hurricane engineering

and earthquake engineering, have developed to deal with engineering

aspects of hurricane and earthquake hazards.

While the broader focus of the disciplines is on designing, constructing and maintaining buildings and infrastructure to withstand the effects of catastrophic events, in insurance

catastrophe modelling the emphasis is on quantifying the damage that

would result from hurricanes and earthquakes of various intensities. Similar

principles can also be applied to the risk of manmade catastrophic events

such as acts of terrorism.

Estimating the dependence of mean damage ratios on hurricane peak

gusts or earthquake physical characteristics for various types of structures is

the process of constructing vulnerability functions, which are an essential

part of the damage calculator in insurance catastrophe models.

Constructing sets of vulnerability functions for specific geographical areas

is necessary to take into account the overall topography, building codes

and the history of their change over time, and other factors.

Demand surge

A catastrophic event such as a hurricane landfall or an earthquake can resultin the increase of costs of repairing the damage and other expenses covered

by insurance policies above the level of claim costs expected under normal

circumstances. This effect is referred to as demand surge, reflective of the

increase in costs being driven by a sharp increase in demand while the

supply lags behind.

An example is the shortage of building materials following a major hurricane, when many properties are damaged and all of them require building materials for restoration, all at the same time immediately following the hurricane. The cost of building materials naturally

goes up to reflect the demand–supply imbalance created by catastrophic

events.

The post-event shortage expands to the labour costs, which also

affect the cost of rebuilding the damaged property. Additional living

expenses can also grow after a large catastrophic event, further contributing

to losses suffered by insurance companies.

To account for demand surge, insurance catastrophe models can apply

special demand surge or loss amplification factors to insurance losses. The greater the magnitude of a catastrophic event, the greater the demand surge

effect. The effect applies to different parts of insurance coverage to different

degrees; consequently, demand surge factors differ as well. Sometimes the

factors are further refined to reflect the various degrees of the demand surge

effect, for example on the cost of rebuilding various types of property.

Aggregate approach

An aggregate approach, as opposed to the more detailed location-by-locationmodelling, starts before the financial loss module, in the analysis of

hurricane damage. The goal here is to arrive at aggregate insured losses for

an individual risk portfolio or even for the whole insurance industry. In this

approach, portfolio-level information is used in the calculations to arrive at

the loss distribution, as opposed to analysing each individual risk independently

and then aggregating the losses across the portfolio.

Inventory databases of property exposure are utilised to help accomplish this goal,

with the data aggregated by location (such as ZIP or postal code) and

including information on the types of property, vulnerability degrees, type

of coverage, etc. The calculations consider aggregate exposure data by location,

estimate the average damage and then translate it into financial losses.

When this is done not for an individual portfolio of a specific insurance

company but for the whole insurance industry, the result is a figure for

industry-wide losses by geographic area (for example, all of Florida), the

probability distribution of which is important for larger primary insurance

writers, and even more important for reinsurance companies.

There are other ways to calculate aggregate losses, which are based on

more granular analysis and the use of databases of insurance policies from

several insurance companies, and then extrapolating the losses to the total

insurance industry based on insurance premiums or another measure of

exposure. Some modelling companies might have developed such databases

by combining data from the companies that provided them with this

information.

In the context of insurance-linked securities, aggregate losses suffered

by the insurance industry are important in catastrophe bonds with an

industry loss trigger, in industry loss warranties (ILWs) and in catastrophe

derivatives.

auto Insurance always a high priority concern for all the drivers they know and understand how important it is for them, the best car insurance for young drivers is here

ReplyDeleteVery insightful article. It shows clearly where the industry needs improvement

ReplyDelete